Tuesday, October 31, 2006

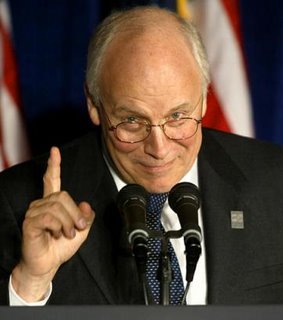

Cheney Criticizes Sarbanes-Oxley

Cheney is obviously getting ready for his (overt) return to the corporate world.

Vice President Dick Cheney suggested Monday he wouldn't support new hedge-fund regulation and said the Sarbanes-Oxley law passed four years ago may have gone "too far" in safeguarding investors from corporate fraud.

"I'm reluctant to see additional regulation," Cheney said in an interview with CNBC television, when asked about hedge funds and corporate ethics. "We have to be very careful about slapping on new regulations or trying to respond to the political pressures of the moment by making life even more burdensome than we have."

The Treasury Department is leading a task force that is examining the impact of hedge funds on financial markets. The inquiry also involves the Securities and Exchange Commission, the Federal Reserve and the Commodity Futures Trading Commission.

Cheney said the Bush administration would "be happy to work with" Democrats on changing Sarbanes-Oxley, a law passed in 2002 that imposes stiffer penalties on companies for committing fraud.

"I do think there needs to be some work done in that area," Cheney said. "You can make a case that Sarbanes-Oxley went too far."

Pressure to regulate the industry has intensified since the collapse last month of Amaranth Advisors LLC of Greenwich, Conn., which lost $6.6 billion -- the most ever by a hedge fund -- because of bets on natural gas.